Credit reports and scores are often talked about, yet not a fully understood aspect of growing up. WSECU wants its members to be financially savvy. Your credit history is like a shadow that follows you around forever. It can be dark when your financial history is damaged. It can be sharper with clean-up and careful attention. WSECU’s team of certified financial coaches is ready to assist you with your current needs and long-term goals. You’ll get support to move forward with confidence.

“It’s important to get off on the optimal financial path or get credit help when things go awry. We genuinely care and take time to listen,” says Stacy Lucero, Vice President of Service Delivery Administration. WSECU realized many people need help understanding what a credit score and financial responsibility mean. “We are always looking for ways to help our members,” adds Lucero.

A Credit Report Reflects Your Ability to Pay

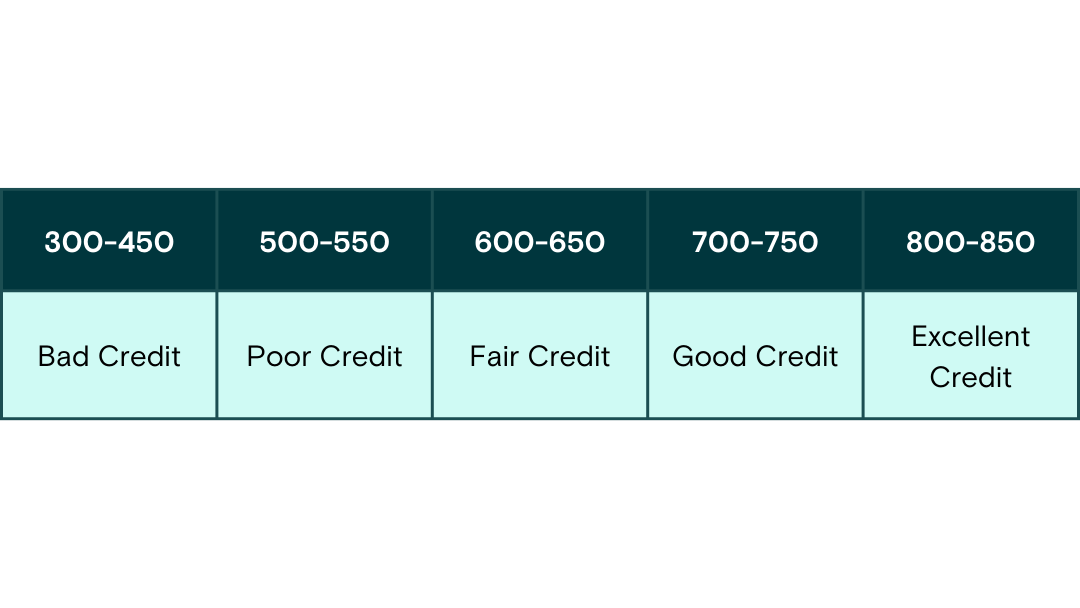

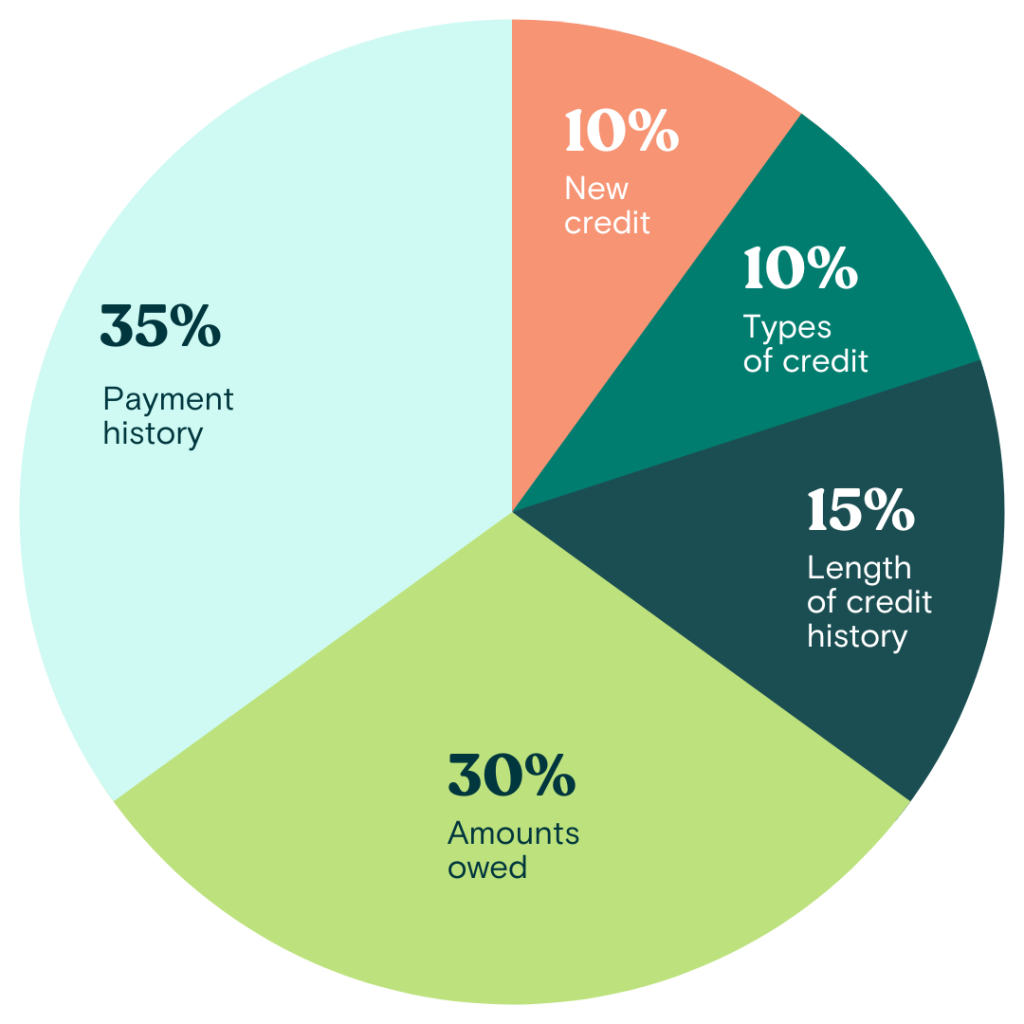

A credit score is generated from a compilation of information from a person’s credit history. It evaluates how likely a person who borrows money or is given credit will pay it back as agreed. The report tracks your payment history on money you have borrowed – things like credit cards, student loans and if you’ve co-signed on a loan for another borrower. It shows when and how late you are on payments and the limits on your accounts. Credit reports count the times you pay on time and are 30, 60, and 90 days late. It also shows collections. For the best credit, you want your report to show that you are a responsible borrower, which is made up of five main factors: payment history, the amount owed, length of credit history, types of credit and the amount of new credit or inquiries on your report. Your income is not tied to your credit report, meaning a strong credit score is independent of your current or past jobs.

A credit score has an impact on more than just borrowing money. A strong credit score might mean better auto insurance rates and easier approval when applying for a rental home, while a weak credit score might limit your options when choosing a monthly cell phone plan with a new device. A low credit score that leads to a higher interest rate on a loan payment or fewer borrowing options might make it more difficult to pay back what you owe, which could cause late payments that, in turn, negatively impact your credit score.

“That kind of vicious cycle is what we want to help members avoid,” Lucero said. “But having bad credit or no credit can be fixed. It takes time, but you can take control and improve your score if you know what’s negatively impacting it and what would improve or build it.”

Making payment arrangements, consolidating debt or meeting with a financial coach are all steps members can take to get ahead of or out from underneath ongoing credit challenges.

Credit Score Begins When You Start Credit

“It does take a few months to build a score,” Lucero said. As soon as you are extended any kind of credit, the information is tracked in your credit report. You might start building your credit by applying for a credit card with a maximum balance that fits within your budget. Each month, charge only what you can repay and make payments on time to start positively building your credit score. As your history builds, you will put yourself in a position to receive better rates and more options for credit. To ensure payments are on time, you can use automatic payment methods to avoid delinquent payments on your report.

Agencies evaluating your credit will look at the maximum you can borrow if all your cards were maxed out, which is your debt load. To optimize your usage while building your credit or improving your score, a good rule to use is to keep your balance at 30% or lower than your total upper limit. Keep in mind a large number of credit cards doesn’t directly translate to a good credit score in the same way that having only one with a continuous zero balance does not mean much.

Annual Free Credit Report

You can receive one free credit report each year through the Annual Credit Report website. This will give you the outline of what things are included on your credit report and what is impacting your score. Keep in mind there are three major credit reporting agencies: Equifax, Experian, and TransUnion, each of which could have a slightly different score, so there will be some variation between what you anticipate your score to be and what a lender sees. Once you receive your report, take a close look to check for accuracy. Mistakes can be corrected. If you have questions, your WSECU Financial Coach can talk it over with you.

WSECU Can Help Clean Up Your Credit

Ellory Rowe is one of WSECU’s certified financial coaches. She found many people she speaks with have gaps in their general financial education that can be addressed in coaching sessions. “It’s so easy to use plastic. It adds up quickly,” she notes. When credit history gets messy, customers are overwhelmed and are uncertain of what to do. “There can be a disconnect between spending and paying,” adds Rowe. She can show you ways to get on a better spending and paying track.

Consult with a WSECU Financial Coach

Whether you are new to the credit world or already established, WSECU has your best interests at heart. During your meeting, you can go over your credit report and other information with a fine-toothed comb. You can talk about budgeting, credit and spending habits, saving strategies and your goals. A one-on-one session with a financial coach is an opportunity for you to address any roadblocks you’re facing in your unique money management situation. “We are focused on solutions and a member’s entire financial picture,” Rowe said.

“We get excited for our members to buy a house or reach a goal!” says Rowe. Whether your goal is about achieving a financial dream in the near term or helping build your toolbox to pass financial management knowledge to your family, let WSECU support you on your healthy financial journey. Visit the WSECU website for further information.

Sponsored